irs child tax credit 2022

The child tax credit isnt going away. Page Last Reviewed or Updated.

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

When is the IRS releasing refunds with CTC.

. The total amount of the advance Child Tax Credit payments that you and your spouse received during 2021. You could receive your money as early as February 19 but in a lot of cases it will not be until March 1. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there.

Most parents who received monthly payments in 2021 will have more child tax credit money coming this year. That agency processes not just tax refunds but the child tax credit including the expanded version that was paid monthly directly to families during the last half of 2021 and the earned income tax credit. The IRS suggested If you file a joint 2021 tax return with your spouse you will need to compare.

The American Rescue Plan Act ARPA of 2021 expanded the. The amount of the Child Tax Credit that you and your spouse can properly claim on your 2021 tax return. There is no indication to support speculation that this could.

The Child Tax Credit provides money to support American families helping them make ends meet more easily. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. These FAQs were released to the public in Fact Sheet 2022-28 PDF April 27 2022.

That meant if a household claiming the credit owed the IRS no money it couldnt collect its. COVID Tax Tip 2022-03 January 5 2022. COVID Tax Tip 2022-31 February 28 2022.

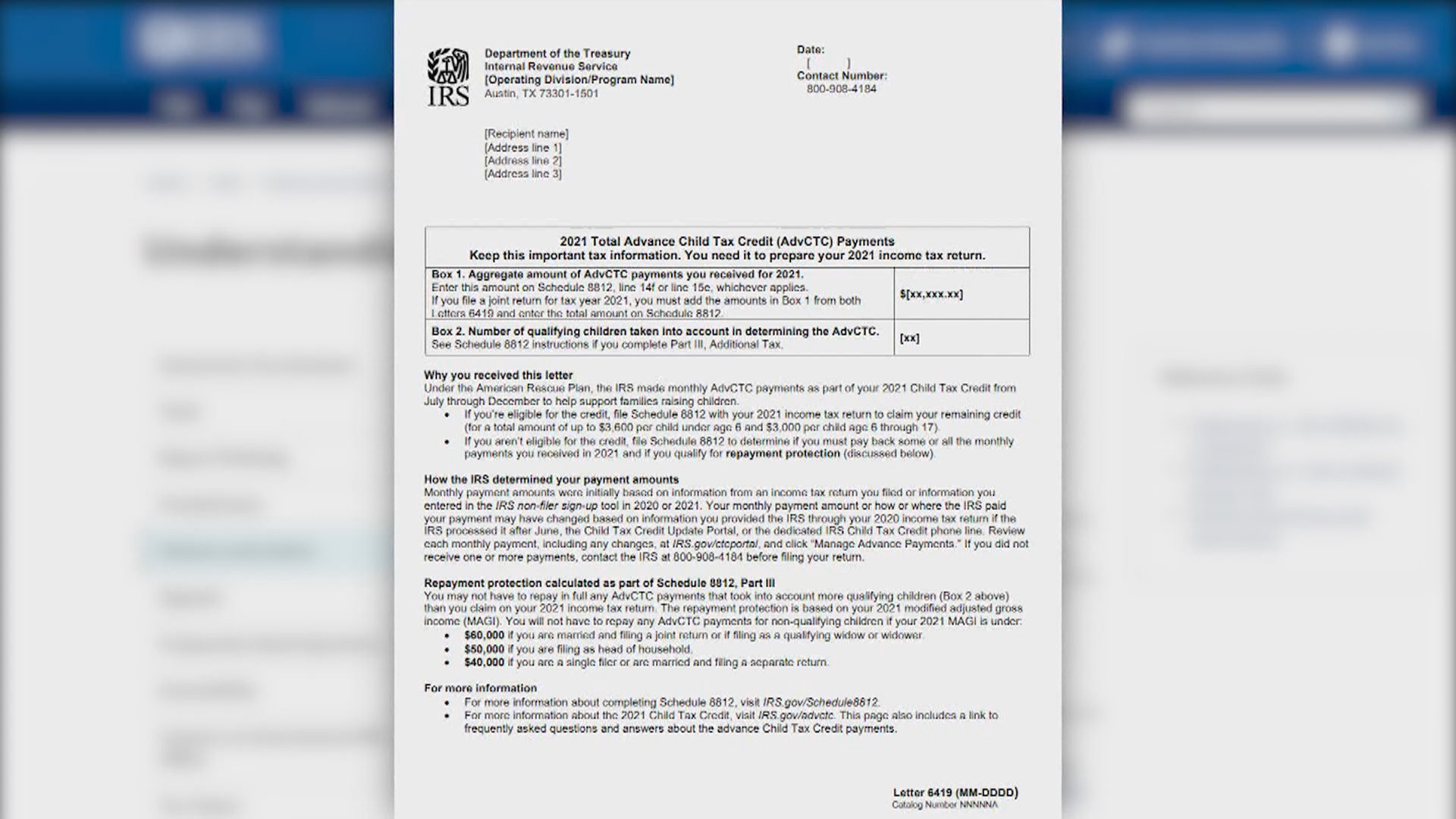

Not only that it would have modified it to include the following. Ad The new advance Child Tax Credit is based on your previously filed tax return. The IRS started issuing information letters to advance child tax credit recipients in December.

That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous maximum of 2100. IRS Child Tax Credit Portal 2022 Advance Payments Monthly Payment Amounts opt-out. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. 2 days agoSome of the direct aid paid to families during the COVID-19 pandemic hit citizens wallets by way of the IRS. Recipients of the third round of the Economic Impact Payments will begin receiving information letters at the.

IRS Child Tax Credit Money. The Child Tax Credit Update Portal is no longer available. January 27 2022 The IRS is reviewing the situation but we believe this is a limited group of taxpayers involved out of a much larger set of advance Child Tax Credit recipients.

Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable. For 2022 the tax credit returns to its previous form. How the child tax credit will look in 2022 The good news is.

IRS started Child Tax Credit CTC Portal to get advance payments of 2021 taxes. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. 1 day agoThe IRS suggested If you file a joint 2021 tax return with your spouse you will need to compare.

IRS Tax Tip 2022-33 March 2 2022. But without intervention from Congress the program will instead revert back to. Child Tax Credit 2022.

The recent expansion of this credit means that more people may qualify to have some much-needed money put back in their pocket. The EITC is one of the federal governments largest refundable tax credits for low-to moderate-income families. IRS sending information letters to recipients of advance child tax credit payments and third Economic Impact Payments.

The total amount of the advance Child Tax Credit payments that you and your spouse received during 2021. Families who are eligible for CTC Portal can get advance payments of. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico 2021 01212022 Inst 1040-SS.

Dont Miss an Extra 1800 per Kid. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for children between 6 and 16 years of.

The amount of the Child Tax Credit that you and your spouse can properly claim on your 2021 tax return. Child Tax Credit 2022 02242022 Publ 972 SP Child Tax Credit Spanish Version 2022 02252022 Form 1040-SS. In the meantime the expanded child tax credit and advance monthly payments system have expired.

File a free federal return now to claim your child tax credit. The Child Tax Credit helps all families succeed. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Other direct aid requires.

Irs Urges Parents To Watch For New Form As Tax Season Begins

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Child Tax Credit 2022 Irs Warns Of Errors In Letter 6419 What Should You Do As Com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Stimulus Checks Will Still Be Issued In 2022 After Final 2021 Child Tax Credit Payment Sent Directly To Americans

What Families Need To Know About The Ctc In 2022 Clasp

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Will You Have To Repay The Advanced Child Tax Credit Payments

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Irs Form W4 With Child Tax Credit 2022 Youtube

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas